LEVY FOR LIFE

ON OUR PENSIONS

THE GOVERNMENT’S LEGACY

____________________________________

Click Here for Link to Radio Kerry Interview with ESBRSA Chairman Tony Collins re 7.7% Pension Raise Claim

Update 25th. July, 2024

The death has occurred of Alo Brady, retired from ESB Head Office and known by many throughout ESB, particularly in the area of industrial relations over many decades.

The death has occurred of Victor Kelly, ex ESB Telecoms, System Op. and relief shift engineer LDO.

Please share these sad news with your colleagues and friends.

Funeral details are available on RIP.ie

May they rest in peace.

Update 24th. May, 2024

ESB RETIRED STAFF ASSOCIATION

Please see attached Press Release, issued by Sue Shaw & accompanying document (Update 13th. May) which is designed to encourage all of our members to engage with the candidates on ESB RSA issues. In particular, it highlights the importance of asking where they and their party stand on the Industrial Relations Bill (Provisions in respect of Pension Entitlements of Retired Workers). A public meeting of the membership of all of the organisations, of which ESB is a member will take place in the Unite Trade Union Offices, details as follows:

Where: Unite Trade Union Offices When: Tuesday, May 28th. 55/56 Middle Abbey Street Time: 11.00 am Dublin

It is a special media event. There will be journalists & speakers from across all of the organisations affected by these pensions issues.Please come to this event and make your voice heard.

PRESS RELEASE

IRSIH SENIOR CITIZENS PARLIAMENT

FOR ATTENTION NEWS EDITORS.

What: Briefing session to retired employee associations on the progress of the INDUSTRIAL RELATIONS BILL

Where: UNITE TRADE UNION OFFICE, MIDDLE ABBEY STREET, DUBLIN.:

When: 11 AM TO 1 PM

The Collective Network of Retired Workers under the aegis of the Irish Senior Citizens Parliament are holding a briefing session for members on the current position of the INDUSTRIAL RELATIONS (PROVISIONS IN RESPECT OF PENSION ENTITLEMENTS OF RETIRED WORKERS) BILL 2021.

This will take place on the 28 th May @ 11.00 am. There will be short Press

Conference following the session in UNITE OFFICES Middle Abbey Street.

Speakers at the event are: Brid Smith TD (proposer of the Bill) Dr Nat O Connor

AGE ACTION; Pat Mellon ISCP, John Nugent and Paddy Fagan from the Collective Network.

The event aims to highlight the delays and lack of progress in relation to the

INDUSTRIAL RELATIONS (PROVISIONS IN RESPECT OF PENSION

ENTITLEMENTS OF RETIRED WORKERS) BILL 2021.

The Bill supports the rights of retired employees to have a say in any negotiations that will impact their pension provision. To date they have been left out of this process and this has resulted in pension poverty for many retired employees as there has been a cumulative effect over the years.

Retired employees believe that it is this Government plan to let them ‘age out’ before rights are granted. Many of the members who started this campaign have sadly passed away without seeing any change to the lack of equality for retired workers.

This Bill is the first serious attempt to address this inequality.

ENDS

CONTACTS for information/interview

John Nugent 0872079504; Joe Little 0872433209; Tony Collins 086 8197083; Paddy

Fagan 086 2251338

PRESS RELEASE

Update 13th. May, 2024

ESB RETIRED STAFF ASSOCIATION

To All delegates & Branch Secretaries

11 th May 2024

Dear Colleagues,

You are all aware of the imminent local & European elections next month and the fact that all prospective candidates are actively canvassing now.

With that in mind the National Executive are urging all members to use the opportunity to lobby any prospective candidates on the issues that are important to our Association.

WE ARE RETIRED WORKERS NOT RETIRED VOTERS

The importance of Brid Smith’s Private Members Bill, The Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill 2021 cannot be underestimated.

Retired Workers in Ireland do not have a voice or Forum for redress on issues which can affect their current and future pension rights & entitlements. These issues arise from agreements between employers and Trade Unions which can interfere with those rights. You will all remember the Pensions Agreement in 2010 between ESB Management and Trade

Unions, which excluded pensioners, but had a major impact on pensioners future financial security. This agreement eliminated pay parity with employees for pensioners without their agreement and the resulting lengthy pension freezes which effectively lasted for 12 years.

The above-mentioned Bill is seeking to address this injustice to pensioners. Workers have access to the WRC to arbitrate on issues they may have with their Employers.

What this Bill is attempting to do is to give pensioners a voice and access to a Forum similar to the WRC which could arbitrate on situations where pensioners rights & entitlements are being affected. Pensioners are not interested in interfering with the IR process but only in situations where pension rights are up for discussion.

The Collective Network of Retired Workers, under the aegis of the Irish Senior Citizens Parliament, which comprises all Commercial State & Semi State organisations including ESB, and the Alliance of Retired Civil & Public Servants, have been actively campaigning for this Bill for nearly 3 years now and are looking for the support of all the wider membership of these organisations to actively lobby all Public Representatives and prospective EU/Local election candidates.

There will be a public meeting of the membership of all these organisations in the Unite Trade Union offices 55/56 Middle Abbey Street on Tuesday 28 th May 2024 at 11.00 am. The meeting is intended as a media/publicity event with journalists in attendance and speakers from supporting organizations, such as Age Action.

All members of the organisations which comprise the Collective Network of retired Workers are urging their members to attend this meeting as a show of support & strength for the Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill 2021 and the successful passing of this Bill into legislation.

SAVE THE DATE

ACTION FOR OCCUPATIONAL PENSIONERS’ RIGHTS.

Tuesday MAY 28 TH. 2024

UNITE TRADE UNION OFFICES

55-56 Middle Abbey St, North City, Dublin 1, D01 X002

11.00am-1.00pm

The following quote from a letter from Mairead McGuinness (MEP) to Clare Daly (MEP) highlights the protection of pensioners property rights in the context of their constitutional rights.

I am aware of the situation of the Irish Airlines (General Employees) Superannuation Scheme (IASS), including the 2020 judgment by the High Court of Ireland confirming that the interests of IASS pension scheme members within the trust affords them a property right enjoying constitutional protection. (’) This view is consistent with the case-law of the Court of Justice of the European Union. (2)

The Irish Government intend to implement a new Pensions Auto enrolment system in January 2025. This is very much a “buyer beware” situation for prospective members of the scheme, as how can the Government expect employees to buy in to such a scheme when existing pensioners have absolutely no voice or Forum to seek redress for situations where

their pension rights are being interfered with.

We need to look at the bigger picture here and the Irish Governments attitude to its senior citizens, the rights of those citizens, and the fact that they should have equality of esteem with other sectors of society.

Retired Workers in Ireland feel very strongly about the Irish Governments attitude to the rights of the older cohort of its citizens, an attitude, which they believe discriminates against older citizens and is ageist in the extreme.

The NEC are urging all members to lobby candidates on these particularly critical issues, which would benefit, not only ESB Pensioners, but ALL pensioners in Ireland.

Please ensure that this message gets the widest possible circulation in all your Branches and urge your members to conduct extensive lobbying of all candidates.

WE ARE RETIRED WORKERS NOT RETIRED VOTERS

Tony Collins

Chairman, National Executive

ESB Retired Staff Association

Update 12th. March, 2024

I attach a link to rip.ie for details of his funeralrrangement

Pl use to following link to access the funeral arrangements: https://rip.ie/death-notice/joseph-noel-kavanagh-dublin-tallaght

All Members – Beware of Financial Scams & Phising

It has come to our notice that some members have received shopping vouchers from some of our branches. When they tried to cash them in shops, there was no money on these vouchers. Subsequently, they have made contact with an attached email address in order to investigate the issue. This email address is belonging to a person who was never employed by ESB. We have reason to suspect that this is a financial scam. If you receive one of these, please Block, Delete and Do NOT RESPOND. NEVER CLICK ON A LINK & NEVER GIVE YOUR ACCOUNT DETAILS nor ACCESS PIN to anybody. If in doubt, ignore it.

CHECK YOUR DRIVING LICENCE

Your Driving Licence – Check the expiry date NOW

It has come to our notice that the NDLS (the authority who issue driving licences) are no longer sending out reminders for the renewal of licences. For the pensioners, most of whom are on short duration licences, 1, 2, or 3 years, it is very important that you are aware of your renewal date. If your licence is of the Credit Card Size type, your renewal date is listed as item 4b. You can renew up to 3 months prior to your renewal date and not suffer a time penalty.

You cannot legally drive a car without a valid licence and if you do, you will be subject to penalty points and a financial fine, the latter will depend on the duration from the renewal date. The accumulated penalty points will have insurance implications.

You can renew your licence up to 10 years after it it has expired. However if you exceed the 10 years, you will have to fulfill all the current requirements to obtain a new licence, theory test, learner permit, mandatory recorded training and pass a driving test.

Update 21st. Oct, 2023

Pension Scheme 2022 Annual Report

To get an emailed Copy or Hard Copy of Annual Report: Call OneHR at 01 7026699 option 3 or Email onehr@esb.ie Include your Name, Staff Number & state your preference.

Update 15th July, 2023

ESB MPF have requested that the following be put on the ESBRSA website.

MPF Annual Outpatient Claim 2023 [January and February]

Former ESB MPF members can now submit their Annual Outpatient Claim to ESB MPF for the first 2 months in 2023 (January and February 2023 i.e. for the period prior to the transfer of membership to Vhi).

It will be processed on a pro-rata basis i.e. the excess will be €60 (instead of €360) for a family membership and €46 (instead of €280) for a sole member. The allowable benefits will remain the same.

Claims should be sent by post to : ESB Medical Provident Fund, P O Box 384, Rosbrien, Limerick.

Update 19th, April 2023

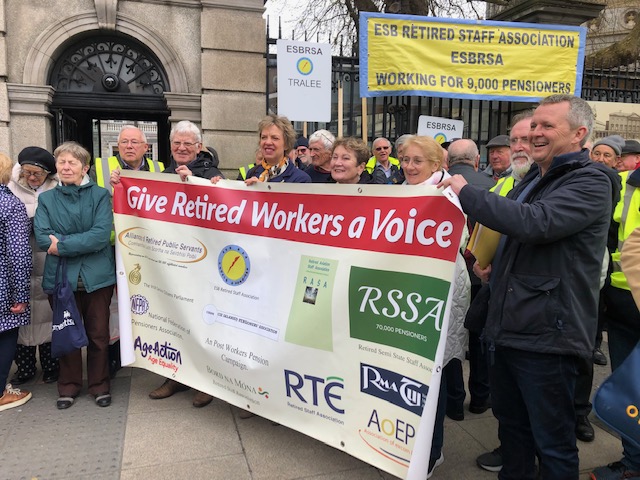

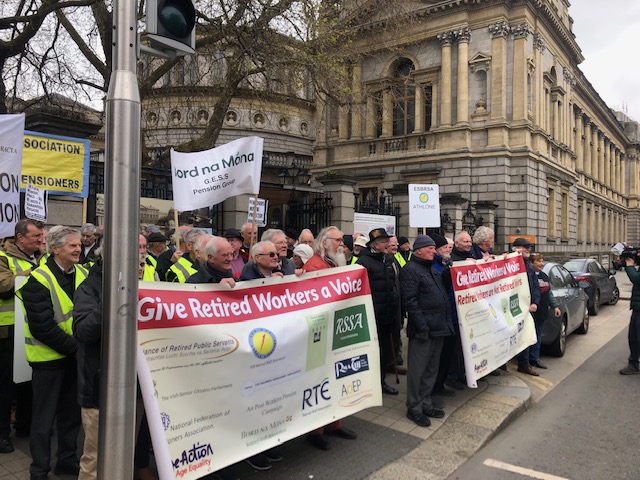

Photos of Demonstration supporting Pensions Bill at Dáil 19th April 2023 with thanks to James Lynch

Update 2nd, February 2023

ESB MPF has requested that the notice below be displayed on the ESBRSA Website for the assistance of MPF members.

Vhi are now issuing policy documents, containing your new Vhi policy numbers, to ESB MPF members who are transitioning to Vhi on 28th February 2023.

The dedicated Vhi ESB MPF concierge service is open to deal with any member queries relating to either the transition or the policy documents you have received.

The contact details for the service are 056 7753175 or by email to esbmpf@vhi.ie

They will also be pleased to help you with queries on your new Vhi plan benefits, cover for ongoing treatment or for new proposed treatment post 27th February 2023.

Update 31st, January 2023

The Joint Oireachtas Committee on Enterprise Trade & Employment held an open session last Wednesday on the pre-legislative scrutiny of the Industrial Relations Provisions in Respect of Pension Entitlements of Retired Workers Bill 2021, which was first read in the Dáil on 30th June 2021.ESBRSA Chairman Tony Collins was one of the witnesses speaking on behalf of ESB Retired Staff Association.

The link below will bring you to a recording of the hearing.

Tony’s opening statement begins at 32 minutes into the recording.

https://bit.ly/3XVNzXh

Update 24th, December, 2022

The National Executive Committee (NEC) wishes all members a peaceful and enjoyable Christmas.

Update 22nd, December, 2022

With regret we inform you of the death of Cathal Quinn on 21st December 2022. Cathal was formerly Area Supervisor ESB Athlone.

The RIP.ie notice for Cathal is below

https://rip.ie/death-notice/cathal-quinn-athlone-westmeath/519053

Update 2nd, December, 2022

Photo from the ESB MPF “Information Event” in ESB H.O. on Wednesday 30th November with thanks to Michael Hughes.

Update 1st, December, 2022

ESB Medical Provident Fund Virtual AGM Notice & Agenda

The 2022 MPF AGM will again be a virtual event this year.

The Trustees, in accordance with Rule 9.3, have convened the Annual General Meeting of the ESB Staff Medical Provident Fund for the following date and time:

Date: Monday 5th December 2022 Time: 5pm

If you are a member of the Fund and would like to attend, please email mpf@esb.ie (including your Policy or Staff Number in the email) or contact the MPF office at 061 430561 to receive your log in details. It will be an MS Teams event.

Agenda

1. Minutes of AGM held on 4 th November 2021

2. Adoption of Minutes

3. Trustees update for the year 2021

4. Audited Accounts for year ended 31 December 2021

5. Update on future direction of MPF 6. Any Other Business

Update 4th November, 2022

To All ESBRSA Members’

The email message below issued today Friday 4th November to members of ESB MPF

MFMedical Provident Fund (Enterprise Services) <mpf@esb.ie>Fri 04/11/2022 14:43

November 2022

Dear Member,

Welcome to our third newsletter of 2022 where we share with you relevant information about your fund and provide you with notice of the ESB MPF AGM.

ESB MPF AGM 2022 Notice

The ESB MPF AGM will again be a virtual event this year and will be held on Monday 5th December 2022 at 5pm (details on how to register your intention to attend the AGM are noted below).

Fund Update

In our last newsletter, I advised that an agreement had been reached with a provider which the trustees believe will ensure that our members continue to receive top-class health cover. I am happy to confirm our provider of choice as Vhi Healthcare. The Medical Provident Fund membership will transfer to Vhi Healthcare effective from 28th February 2023.

The necessity for change and why the trustees embarked on this process has been communicated regularly at MPF AGMs and in newsletters. Some of these reasons include:

- The ageing profile of the fund members and the difficulity in recruiting new members thus resulting in a continuously falling membership number

- MPF is excluded from the risk equalisation scheme which would grant access of up to €9m additional funds per year for the Fund – in essence the market saying we need that to survive

- MPF has a restricted membership licence which means we can’t source membership from the open market and child associate members cannot remain indefinitely in the fund

- The continuing and significant increases in cost of private medical care

We are delighted to be partnering with Vhi Healthcare knowing that this partnership will give us access to cutting edge benefits and services, offering you a healthcare experience unlike any other. The following are just some of the key benefits you will have access to:

- Comprehensive public and private hospital cover

- Cash back for a range of day-to-day medical expenses

- Exclusive access to the Vhi 360 Network; providing access to services including urgent care, diagnostics & health screening

- Access to Vhi Hospital@Home

- Overseas cover

- Vhi App – Access Snap&Send claiming, Vhi Online Doctor and much more

In order to assist you with the transition to Vhi Healthcare, we have scheduled a number of dedicated information events. At these events, you will have an opportunity to learn all about the proposed new arrangement including the benefits, cost arrangements and how the risk reserve will be used for the benefit of all members. The dates for the upcoming events are as follow:

Monday 21st November 2022 @ 5pm – Virtual meeting held on Microsoft Teams

Wednesday 23rd November 2022 @ 5pm – Limerick (venue to be confirmed)

Thursday 24th November 2022 @ 5pm – Cork (venue to be confirmed)

Tuesday 29th November 2022 @ 5pm – Athlone (venue to be confirmed)

Wednesday 30th November 2022 @ 5pm – ESB Head Office, F27, Dublin

Monday 5th December 2022@ 5pm – AGM – Virtual meeting held on Microsoft Teams (including dedicated information update on partnership attended by VHI Healthcare team)

The in-person meetings are obviously subject to covid and should there be a change in circumstances will be transferred to being online.

If you would like to attend any of the above sessions, it is necessary to contact the MPF administration team to confirm your attendance. This can be done via phone by contacting 061- 430561 or by email [stating name, ESB staff number and event you wish to attend] to mpf@esb.ie and we will then arrange to furnish you with login details and/or the venues for the information event you wish to attend.

It is also important to note, on 9th January 2023 your information will be sent to Vhi Healthcare to ensure a hassle-free experience for you and to maintain continuity of cover. Please note only the minimum essential information will be forwarded and it will not contain any medical or bank details. If you would prefer that your information (or that of any member you subscribe for) is not sent, please notify the MPF Admin Team in writing or by email by 31st December 2022. You will receive your VHI Healthcare policy documents in early February. You can make changes or cancel your Vhi Healthcare policy up to 14 days following your renewal date of 28th February 2023.

I look forward to engaging with you at the events and AGM over the coming weeks and addressing any questions or feedback you may have.

Best Regards,

Pensions and Insurance Manager

Update 31st October, 2022

Dear Member,

All Medical Provident members will have received a newsletter last July concerning an agreement that had been reached between Trustees of MPF and an unnamed medical insurance provider to provide continuing and improved medical cover for MPF members. There was a promise to contact members about various upcoming dedicated information events and number of on-site meetings where the Trustees will share in detail the outcome of their fund review process.

RSA sent a letter (see letter below) to James O’Loughlin, Manager MPF on 25th July, outlining the concerns of pensioners regarding the future of MPF and this proposed alliance with another insurer.

To date RSA have not received a response to that letter or subsequent reminder letters, nor has there been any communication from MPF re information meetings. The MPF Manager has, however, recently been in contact offering a face to face meeting with some members of RSA Executive Committee on 15th November, which we are accepting.

This is a very serious situation facing MPF and its membership with the lack of any clear communication from MPF Management causing speculation and serious concern to members, so we urge all members to be vigilant and to make their views known to MPF Management.

RSA are also aware that there will be an MPF virtual AGM on 5th December and would urge all members to register for that event when the notification arrives from Medical Provident Fund.

Mr. James O’Loughlin

Manager, Medical Provident Fund

25th July 2022

Dear James,

I refer to your email to me of 14th June and your subsequent briefing note/newsletter received 18th July. That newsletter states that an agreement has been reached between MPF Trustees and a health insurance provider.

The lack of any detail as to the nature of this deal and whether or not it is subject to ratification by the unnamed insurer and by MPF/MPF members is causing our members considerable concern who fear it is a case of a done deal, already concluded, with only briefing to follow.

Partnership implies the continuing existence of both the MPF and the chosen insurer. Under a proposed new partnership arrangement.

· The identity and status of MPF members should not be diminished in any way

· If MPF are to be net beneficiaries of the Risk Equalisation process, then it should follow that MPF members benefit from reduced premiums.

· Fund reserves belong to MPF members so before any new partnership arrangement is finalised, a mechanism should be put in place to give members the full benefit of those reserves, bearing in mind those members who have contributed most to building the reserve fund.

· How will MPF will be administered going forward, and will Trustees continue to play an important role, representing the interests of the members.

The importance of All MPF members being fully informed of the details of this agreement before any such information events are held should not be underestimated. RSA request that arrangements be made without further delay as follows

· To end the current information vacuum with respect to this proposed deal we ask that a document setting out the details be sent to all members prior to any meetings being organised as this will make the meetings more useful and productive

· Organisers of the forthcoming information meetings should be very mindful of the age profile of MPF members and that for many, virtual meetings are wholly inappropriate. Where onsite meetings are being considered, the locations for these meetings should be fully accessible by public transport and held at a reasonable time of day to suit elderly members.

· On completion of the review process, any changes in the terms and conditions of MPF membership should be subject to the approval of ALL members of MPF.

Jim Devlin, Secretary

Update 20th October, 2022

ESBRSA has written to ESB following the decision not to consult with Retired Staff Members on new Rules of the DB Pension Scheme. We have also written to Eamon Ryan, Minister for the Environment, Climate, Communications and Transport asking him to defer approval of the new rules until there has been consultation with Retired Staff Members. The letters are below.

1. Letter to James O’Loughlin, Group Pensions & Insurance Manager re exclusion of pensioners from the 21 day consultation process on the proposed Pension Scheme rule changes following the implementation of the IORPS11 European Directive on pensions. RSA were engaged in a Joint ESB & RSA Forum for over 8 years at which they were assured that exclusions such as this, would not happen again after the debacle around the 2010 Pensions Agreement, where pensioners were excluded from being a party to that agreement. It seems these words are meaningless.

2. Letter to Eamon Ryan, Minister for the Environment, Climate, Communications and Transport, also re exclusion of pensioners from the 21 day consultation process on the proposed Pension Scheme rule changes following the implementation of the IORPS11 European Directive on pensions with a request not to approve the ESB Pension Scheme rule changes until the consultation process is rerun to include pensioners.

4th Oct 2022

Mr. James O’Loughlin,

ESB Pensions and Insurance Manager,

Dear James,

I and other pensioners have recently learned of the current consultation process on new rules to the DB pension scheme.

I wish to protest vigorously the exclusion of pensioners from this formal consultation process.

Any rule changes impinge on pensioners every bit as much as on employee members of the scheme and pensioners are as deserving of the same consideration as employees.

This yet again sets to naught management’s words in the joint ESB/ESBRSA forum that the exclusion of pensioners from the process as occurred in 2010 would not be repeated but, of course, it is not the first time that this exclusion has recurred.

The attitude and behaviour of ESB towards it pensioners leaves a lot to be desired and badly reflects on ESB and needs to change.

ESB operates a dignity at work policy. Does that policy existence and content represent core values toward people? It is hard to accept that it is given the continuing exclusion of pensioners from pension matter affecting them.

Finally, I call on ESB to re-run this consultation process and open it to all members of the Scheme.

Yours sincerely,

Jim Devlin, H. Sec., ESBRSA

Copy: Mr. Paddy Hayes, CE, ESB

4th Oct 2022

Attn: Minister for the Environment, Climate and Communications, Minister for Transport

Dear Minister Ryan,

ESB Defined Benefit Pension Scheme has some 12,000 members of who only 1 in 4 is an employee member. Currently ESB is engaged in a formal 21 day consultation process concerning revised rules to the scheme following their approval by ESB board. These rule changes are to comply with new IORP II requirements as per Irish regulations of last April. The consultation process commenced 14th Sept 2022 and ends tomorrow 5th Oct. The next step is to seek ministerial approval.

I am writing to you today to request that you defer approval and require ESB to re-run the consultation process. The reason I make this request on behalf of ESB pensioners and our organisation, which represents ESB Retired Staff, is that ESB has issued the consultation document to employee members of the scheme only. Not alone have pensioners been ignored but when I, as a pensioner, sought from ESB Pension Office a copy of the new rules I was told “The new rules process is only open to active staff [i.e., employees], so no copy is currently available to pensioners”

Any revision to the rules applies equally to all members of the scheme. Pensioners are equally deserving of being consulted as employee members are.

I conclude by repeating my request on behalf of all ESB pensioners that you defer approval and require ESB to re-run the consolation process in the interests of equality of treatment for pensioners and respect for their views on the rule changes.

I attach also a letter sent today to ESB.

Yours faithfully,

Jim Devlin, H. Sec., ESBRSA

Update 12th October, 2022

Photos taken at the September Annual General Meeting of ESBRSA Head Office Branch. With thanks to Michael Hughes

Update 30th September 2022

At a recent Dublin H.O. Branch meeting a presentation on the “Fair Deal” scheme was made by Mary Courtney. Her slides are available via the link below.

http://www.esbrsa.ie/wp-content/uploads/2022/09/Fair-Deal-Module-ESB.pdf

Update 21st August 2022

The following is a letter sent to Manager, Medical Provident in response to the newsletter received by all members on 18th July 2022.

Mr. James O’Loughlin

Manager, Medical Provident Fund

25th July 2022

Dear James,

I refer to your email to me of 14th June and your subsequent briefing note/newsletter received 18th July. That newsletter states that an agreement has been reached between MPF Trustees and a health insurance provider.

The lack of any detail as to the nature of this deal and whether or not it is subject to ratification by the unnamed insurer and by MPF/MPF members is causing our members considerable concern who fear it is a case of a done deal, already concluded, with only briefing to follow.

Partnership implies the continuing existence of both the MPF and the chosen insurer. Under a proposed new partnership arrangement.

· The identity and status of MPF members should not be diminished in any way

· If MPF are to be net beneficiaries of the Risk Equalisation process, then it should follow that MPF members benefit from reduced premiums.

· Fund reserves belong to MPF members so before any new partnership arrangement is finalised, a mechanism should be put in place to give members the full benefit of those reserves, bearing in mind those members who have contributed most to building the reserve fund.

· How will MPF will be administered going forward, and will Trustees continue to play an important role, representing the interests of the members.

The importance of All MPF members being fully informed of the details of this agreement before any such information events are held should not be underestimated. RSA request that arrangements be made without further delay as follows

· To end the current information vacuum with respect to this proposed deal we ask that a document setting out the details be sent to all members prior to any meetings being organised as this will make the meetings more useful and productive

· Organisers of the forthcoming information meetings should be very mindful of the age profile of MPF members and that for many, virtual meetings are wholly inappropriate. Where onsite meetings are being considered, the locations for these meetings should be fully accessible by public transport and held at a reasonable time of day to suit elderly members.

· On completion of the review process, any changes in the terms and conditions of MPF membership should be subject to the approval of ALL members of MPF.

Jim Devlin, Secretary

Update 19th August 2022

RSA has learned that an increase of 3.7%, being the rate of inflation Sept 2020 to Sept 2021, will be paid. There is no further information at this time as to when it will be paid.

Update 11th August 2022

The new ESB Head Office now referred to as F27 ( 27 Lr. Fitzwilliam Street Dublin 2) is now completed.

It may be of interest to retired staff to know that the Bialann / Restaurant is accessible to them. In order to gain access it is necessary that you take a short induction course for Health and Safety purposes at the reception desk.

The Bialann opens for lunch at 12:00

Update 21st June 2022

ESBRSA took part in the Cost Of Living Coalition (COLC) march on June 18 2022 to highlight the plight of ESB Pensioners whose pensions have fallen far behind the Pension Promise and are being eaten into by spiralling inflation.

The link below will bring you to the RTÉ news report on the march.

Update 13th April 2022

Matt Kelly

Dear Members,

The recent issue of Pension Pay Advice slips added overdue retrospection payment to normal pension payment without identification of the retrospection and the tax years during which they should have been paid.

Two emails were sent to ESB Pensions Manager James O’Loughlin about the matter.These emails are copied below..

I intend to email ESB asking for a written certification of the amount of retrospection for each of the years during which they should have been paid so that I may submit it to Revenue. Perhaps if we all do that it will solve a problem that should never have arisen and avoid a repetition in future.

Kind Regards

ESBRSA Website Admin.

Below are two letters sent to Pensions Manager, James O’Loughlin, by Tony Collins, Chairman National Executive, ESBRSA

Dear James,

Further to yesterday’s email, I & my colleagues have received more queries regarding the payment of the pension increase and the manner in which it has been displayed on the payslip.

The retrospective element of the increase spans a number of years and should have been displayed on the payslip showing the amount of retrospection in respect of each year.

Many pensioners in normal circumstances with an average monthly/weekly pension payment are very close to the threshold of the higher tax rate and a lump such as the one just paid will move them into the higher tax bracket. Consequently, they will pay the higher tax rate on their lump sum when in reality if the increase was paid in a timely fashion they would have been taxed at the lower rate.

To be fair to all pensioners consideration should have been given to the above when the pension increases were being applied.

ESBRSA believe that ESB Payroll has a responsibility in this regard and should take steps to rectify the situation by informing pensioners of the correct amount of retrospection in respect of each tax year.

I look forward to hearing your response and that of ESB Payroll on this matter.

Sincerely yours,

Tony Collins

Chairman, National Executive

Dear James,

I hope you and yours are keeping well. Most pensioners will have received their pension payslips by now. I know ESBRSA have received a number of complaints/comments at this stage.It never ceases to amaze me how some people get things so wrong at times.When the previous pension increase of 0.2% was paid some years ago, also in arrears, ESBRSA wrote to you regarding the confusion caused by the layout of the payslip, the retrospective element of the increase was included in the gross pension amount and some pensioners thought that they had received a larger increase than they actually did. Can you imagine their shock/surprise when they realised it was only 0.2%. ESBRSA had to write to our network of branches to explain the payslip.The recent increase has been paid in exactly the same manner. To err once is human, to err twice is careless. When I worked in a wages unit in ESB more than 50 years ago we had a simple basic wages system, but if a wage increase was paid in arrears, the retrospection was displayed separately on the payslip, which was self-explanatory. I fail to understand why, with the sophisticated online real-time payroll system in ESB now, what should be a simple task, appears complicated to the employee/pensioner.The late payment of the pension increase more than 3 years in arrears, apart from being disrespectful of pensioners, particularly the hundreds of those who have passed away in the last 3 years or so and never had the benefit of the increase, also presents another problem in that lump sum payments can mean some pensioners move into a higher tax bracket. We have already received a complaint in that regard at this early stage.On behalf of all pensioners I ask that you consider the above and get it right next time, when the next increase is paid, i.e the 3.7% due from 1st January 2022. Please don’t delay this payment further, as many pensioners are now feeling the effects of the serious increase in inflation and the increased cost of living.

Sincerely yours,

Tony Collins, Chairman, National Executive, ESB Retired Staff Association

Update 8th April 2022

Hello Everyone,

Many Thanks to Freida Murray who asked that we to circulate this lovely Acknowledgement from Margaret Shanahan, wife of the late Liam Shanahan retired, ESB Networks, Distribution Dept., ESB Projects Department and ESBI. We were all saddened when Liam bravely passed away last November, following a prolonged illness.

Thank you from Margaret Shanahan

Dear All,

I would like to take this opportunity on behalf of all my children, grandchildren and extended Shanahan family, to say a very big thank you to all the ESB friends and colleagues that Liam had throughout his lifetime.

Liam would’ve been very proud to receive your beautiful sentiments and memories of him.

Courage, dignity and humour were mentioned so many times, that’s the only way to remember Liam for sure.

Kind Regards,

Margaret Shanahan

Update 25th March 2022

Dear Member,

The Industrial Relations Provisions in Respect of Pension Entitlements of Retired Workers Bill 2021

The Irish government has launched a consultation process on the above Bill, which was first introduced by Brid Smith (PBF) in the Dail on 30th June 2021, and proposes to give retired workers’ access to industrial relations mechanisms for pensions related issues.

The consultation, launched by the Minister of State for Business, Employment and Retail, Damien English TD, will run until Friday 22 April 2022.

The Department are seeking the views of interested parties on a proposal for the introduction of a statutory right for retired persons to be included in collective trade disputes, and how to balance the proposed new rights for retired persons with the current rights and interests of workers and employers who engage in the bargaining process.

The government intends to review submissions by mid-May with further direct stakeholder engagement, including with representative organisations. The outcome of the consultation will feed into the government’s response to the proposals.

The Collective Network of pensioner organisations under the banner of the Irish Senior Citizens Parliament (ISCP) will be making a submission to this process on behalf of all the constituent organisations of the Collective Network.

ESBRSA will also be making a submission as part of this process, so if any of our members wish to contribute to this submission please contact our website coordinator on info@esbrsa.ie and your views will be forwarded to the Executive Committee.

All organisations representing retired workers will be encouraged to make a submission in support of the views put forward by the Collective Network.

Please see below for the template released by the Department for making submissions.

——————————————————————————————————————–

Public Consultation on Retired Workers Access to Industrial Relations Mechanisms for Pension Related Issues

The purpose of this consultation is to seek your views on proposals arising from a Private Members Bill for the introduction of a statutory right for retired persons to be included in collective trade disputes and how to balance the proposed new rights for retired persons with the current rights and interests of workers and employers who engage in the bargaining process, along with considering;

- What, if any, additionality could the proposals provide to the existing protections for retired persons including those provided by the Pensions Authority, the Financial Services and the Pensions Ombudsman;

- The effectiveness of the existing timeframe which already allows a retired person access to the industrial relations bodies in a period of 6-months post-retirement for matters arising pre-retirement please see section 26A Revised Acts (lawreform.ie) and

- Whether there is the potential for new or enhanced methods of consultation through the introduction of alternative systems, networks or fora which might assist retired workers in engaging more fully on pension related issues.

The document provides space for your responses to the questions set out.

Your Name: _____________________________________________________

Organisation (if applicable): ________________________________________

Telephone Number: ______________________________________________

E-mail: _________________________________________________________

Please indicate if this submission is made in a personal/employee capacity, an employer capacity or on behalf of your institution, organisation or group.

Name of company, institution, organisation or group covered by this submission:

Respondents are requested to make their submissions by email to: irsection@enterprise.gov.ie

The closing date for submissions is Friday 22nd April at 3pm. ________________________________________________________________

I. Background

The Government has agreed to carry out a consultation to allow for full consideration of the proposals as set out and the possible implications of these. Part of this detailed consideration also involves a consultation process with the other relevant government departments, representative organisations, trade unions and employer bodies.

To ensure that the views of all stakeholders are considered, submissions are now invited during a six-week public consultation period from Friday 11th March to Friday 22nd April 2022.

Submissions will be reviewed by mid-May with further direct stakeholder engagement, including with representative organisations, scheduled as required. The outcome of the consultation will feed into the Government’s response to the proposals.

II. Existing Protections for Retired Workers’ Pension Entitlements

Protections Under the Pensions Act

Section 50 of the Pensions Act 1990 provides that the Pensions Authority may make a direction to reduce pension benefits payable to, or respect of, all scheme member cohorts (active, deferred and pensioner members) in order to satisfy the funding standard, and continue to allow the scheme to operate.

There are limits in respect of the amount by which pensioner benefits can be reduced. With effect from 25 December 2013:

- No reduction may be made from an annual pension of €12,000 or less and no reduction may be made which reduces an annual pension to below €12,000.

- If an annual pension is over €12,000 and less than €60,000, a reduction may be made by a percentage no greater than 10% and to an amount which is no less than €12,000.

- If an annual pension is €60,000 or more, a reduction may be made by a percentage no greater than 20% and to an amount which is no less than €54,000.

The 2013 changes were designed to spread the risk of scheme underfunding to all scheme member cohorts and to ensure a more equitable sharing of scheme resources where restructuring is required while still providing for significant protections to pension benefits already in payment.

While pensioner members have a protection in law in respect of their pension benefits over and above the protection offered to active and deferred members protections there are also opportunities to make submissions to the trustees of a scheme in the context of scheme restructuring.

Other Protections

There are also safeguards available to retired workers particularly given that pension entitlements are property rights and protected in the courts.

In addition, the Pensions Authority plays an important regulatory role in relation to occupational schemes and the Financial Services and Pensions Ombudsman adjudicates on pension appeals taken by individuals as an avenue to vindicate their rights.

Opportunity for Member Submissions

Current legislation provides that prior to the trustees of a scheme making a section 50 application to the Pensions Authority which could involve reductions to pension payments payable under a scheme, they must consult with the employer, the scheme member, with pensioners and with the authorised trade union representing members.

Trustees must undertake a comprehensive review of the scheme with a view to the long-term stability and sustainability of the scheme. In advance of any application, the trustees must notify members and beneficiaries of the scheme, including pensioners, in writing, of matters relating to the proposed application and provide an opportunity for such persons to make submissions to the trustees. Furthermore, the trustees must in accordance with the Prescribed Guidance in Relation to Section 50 of the Pensions Act, 1990[1], give due consideration to these observations.

In the event that the Pensions Authority makes a Section 50 direction, other than on application by the trustees, legislation also provides that the trustees must notify all member cohorts, and provide an opportunity for members, including pensioner members to make a submission/ an appeal in respect of this direction. Furthermore, in these circumstances, the Authority shall, prior to making such a direction, consider the submissions made.

While the opportunity for member submissions and consideration of these submissions is provided for, it is important to note that trustees may need to act in a timely fashion to ensure the long-term stability and sustainability of a scheme.

III.Publication of Consultation Submissions and Freedom of Information

Any personal information, which you volunteer to this Department, will be treated with the highest standards of security and confidentiality, strictly in accordance with the Data Protection Acts 1988 and 2018. However, please note the following:

- The information provided in the submission form will be shared with relevant Government Departments and State organisations during the review process.

- The Department will publish the outcome of the reviews and the submissions received under this consultation on its website, and

- As information received by the Department is subject to the Freedom of Information Act, such information may be considered for possible release under the FOI Act. The Department will consult with you regarding such information before making a decision should it be required to disclose it.

- If you wish to submit information that you consider commercially sensitive, please identify that information in your submission and give reasons for considering it commercially sensitive.

IV. Note Regarding Responses

Respondents are encouraged to keep their responses within the box accompanying each question. Please answer any questions that are relevant to you or your organisation.

Question 1: Duties of Pension Scheme Trustees

Pension scheme trustees have duties and responsibilities under trust law, under the Pensions Act 1990, as amended, and under other relevant legislation. The duties of pension scheme trustees include administering the scheme in accordance with the law and the terms of the trust deed and scheme rules as well as ensuring compliance with the requirements that apply to these schemes.

Pensioner members may avail of that opportunity to become scheme trustees or nominate others to act on their behalf. However, national and European law prohibits discrimination in the manner in which trustees are appointed.

Once appointed, trustees have a fiduciary duty to act in the best financial interest of all scheme members, whether active, deferred or retired, and must serve all beneficiaries of the scheme impartially. If there is a conflict of interest, then a person’s duty as a trustee must, in law, take precedence over other interests.

Accordingly, any trustee who acts in the interests of one cohort of members, e.g., pensioner members, above the interests of other member cohorts of the scheme would be in breach of his or her fiduciary duty.

| Given the legal and regulatory obligations imposed on pension scheme trustees (see: section_50_-_prescribed_guidance_-_version_3_february_2015_.pdf (pensionsauthority.ie), in particular, their fiduciary duty to serve all scheme members impartially, and the opportunity for member submissions as part of any scheme restructuring process, what is the effectiveness of the current arrangements and are there any other suggestions as to how the interests and concerns of retired workers could better inform trustees in their work consistent with the existing legal framework? |

Question 2: Access to Industrial Relations Mechanisms for Retired Workers on Pension Matters

The 1990 Industrial Relations Act currently allows a retired person to access to the industrial relations bodies in a period of 6-month post-retirement for matters arising pre-retirement.

This 6-months is either from the date of retirement or the date from when it became known or should have been known, the time frame in which to make a complaint for matters arising post-retirement. This may be extended by the Labour Court in exceptional circumstances on a case-by-case basis, where the justice of the case so requires.

| Is there a need for the views of retired worker members of pension schemes to be included in the consideration of pension entitlements as part of collectively bargained agreements; if so, how can this be best achieved? Are there any mechanisms that could provide a way for retired worker members of pension schemes to engage with pension trustees in advance of a separate collectively bargained agreement impacting on pensions? Are there any disadvantages or challenges that introducing such a mechanism might impose on the voluntary dispute resolution mechanism? If so, what are these? Could there be any deterrent effect of such a mechanism on the willingness of parties to engage in collectively bargained agreements and as part of the existing IR structures more generally? |

Question 3: Retired Workers and Collective Bargaining

| Could the views of retired workers be balanced with those of workers and employers engaged in negotiations to reach collectively bargained agreements? If so, on what basis? |

Question 4: Implications for Workers and Employers

Question 5: Redress Mechanisms for Retired Workers

There already exists safeguards to retired workers to protect their pension rights. Accrued pension entitlements represent property rights which can be vindicated in the courts. Members of occupational pensions schemes also currently have recourse to the offices of the Pensions Authority and the Financial Services and Pensions Ombudsman.

Any other comments including the potential for new or enhanced methods for consultation:

UPDATE 23rd December, 2021

The National Executive Committee (NEC) wishes all members a peaceful and enjoyable Christmas.

UPDATE 1st November, 2021

ESBMPF have requested that the information below be posted on our website.

ESB Medical Provident Fund

Virtual AGM Notice & Agenda

The 2021 MPF AGM will again be a virtual event this year.

The Trustees, in accordance with Rule 9.3, have convened the Annual

General Meeting of the ESB Staff Medical Provident Fund for the

following date and time:

Date: Thursday 4th November 2021

Time 5pm

If you are a member of the Fund and would like to attend, please

email mpf@esb.ie (including your Policy or Staff Number in the

email) or contact the MPF office at 061 430561 to receive your log

in details. It will be an MS Teams event.

Agenda

- Minutes of AGM held on 10th November 2020

- Adoption of Minutes

- Trustees update for the year 2020

- Audited Accounts for year ended 31 December 2020

- Update on future direction of MPF

- Any Other Business

UPDATE 10th October, 2021

RESULTS OF THE ESOP MARKET DAY OF 29TH SEPTEMBER

For more information see the ESOP website http://www.esbesop.ie/news.html

ESB ESOP

Internal Market Results Announcement

The Internal Market held on 29 September 2021 has now been completed.

PricewaterhouseCoopers (PwC), the Internal Market Administrator, has advised the

ESOP Trustee that the weighted average successful bid price was €1.12 per share (the

Market Price) and this is the price that will be paid to all successful sellers.

Please note that all forced sale shares were sold. Participants who offered shares for

voluntary sale at minimum prices equal to or below the market price have been

partially successful and sold approximately 29% of shares offered.

PwC will be contacting all participants who submitted market instructions. Payments

to successful sellers are scheduled to begin issuing on 13 October 2021.

UPDATE 22nd September, 2021

ESB has requested that the information below regarding the flu vaccination programme 2021 be posted on the ESBRSA website.

ESB Occupational Health wish to update you on the flu vaccination programme 2021.

HSE are providing free flu vaccinations to all individuals who fall into the at-risk or recommended group which include individuals aged 65 and over.( this maybe be subject to change)

They are also offering a different ‘adjuvant’ flu vaccine for those aged 65 years and over for the first time. This vaccine is only available from the HSE, and will be provided provide through the HSE scheme to those eligible and where stock availability. For more information on Flu vaccine for people over aged 65 and over.

If you are in this category you can receive your flu vaccine directly through your local GP or pharmacy free of charge by declaring that you fall into the at-risk or recommended group. Therefore, for this year’s flu vaccination programme we ask you not to request a voucher through ESB.

The full list of the ‘at risk or recommended groups’ are available on the HSE website.

Vaccines will be available nationwide around 4th October 2021.

For VS staff who are under 65 and do not fall under at-risk or recommended group. You can avail of your vaccine through alternative route through your GP or pharmacy. We wish to support you in doing so by offering a refund of up to €35. All you need to do is submit a refund request form available and you will be refunded through payroll. All refunds will be processed in the 1st quarter of 2022. Please email your receipt and attached form to esbhealthservices@esb.ie or post them to Occupational Health Services, Mailing Room Matthews Building, 38/42 James Place East, Dublin 2.

UPDATE 11th July, 2021

Thanks to David Grundy two photos of groups of Communications Section, System Operations Dept. members dating from the late 1960s have been added to the Gallery.

UPDATE 2nd July, 2021

The Government Amendment to the Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill

2021 — Second Stage which proposed that the Bill be read a second time this day 12 months was carried.

It is significant that the amendment omitted consultation with Retired Workers

“to allow for consultation between the Minister for Enterprise, Trade and Employment, the Minister for Social Protection and the Minister for Public Expenditure and Reform, with unions and employers and the Industrial Relations bodies, which will allow for full discussion and exploration of legal and technical issues that may arise, such as increased business costs and business viability, as a result of the proposals and to consider other options for change which might be available, and which would make it more suitable for collective bargaining.” – (Minister of State at the Department of Enterprise, Trade and Employment, Deputy Damien English)”

Results are below.

The link below will bring you to an Oireachtas website where you can click on the Show member vote results button to see the names of TDs who voted for and against the amendment

Amendment put :The Dáil divided: Tá, 74; Níl, 62; Staon, 0.

Amendment declared carried.

Motion, as amended, agreed to.

The correspondence below between ESBRSA National Executive Chairman Tony Collins and Micheál Martin T.D. will show bring members up to date on the current situation.

Hi All,

I’m circulating an email that I received from Micheal Martin this morning & my response to that email. I think the Government parties have been rattled and taken aback by the amount of support for Brid Smith’s Bill. Jim circulated the figures for the voting on the Bill and the support for it is significant. I also believe that the Government were surprised by the support that Brid’s Bill received from representative organisations for retired workers and the strength of feeling in the way retired workers have been treated by Government parties. I believe that we need to keep the pressure on the Government and continue to lobby all Government TD’s in order to progress this issue much earlier than the 12 months indicated in the Government amendment. I would urge all branches to encourage their membership to continue with the lobbying campaign and keep the pressure on.

Tony

ReplyReply allForward———- Forwarded message ———

From: Tony Collins <tonycollins6952@gmail.com>

Date: Thu, Jul 1, 2021 at 11:40 AM

Subject: Re: Retired Workers Rights Bill

To: Micheál Martin’s Office <mmartin.constituency@taoiseach.gov.ie>, Micheál Martin <micheal@michealmartin.ie>

Dear Micheal,

Thank you for your response to my email.

I have written to you on several occasions since you became Taoiseach, and this is the first response that I have received from you. I was part of a delegation that met with you and some of your party colleagues in your office at Leinster House in December 2019.

At that meeting, we discussed the range of possibilities on how pensioners could achieve a proper voice and representation/arbitration. At your suggestion it was agreed that the setting up of a separate division of the Labour Court/Workplace Relations Commission, specifically for pensioners, would be the best option for their grievances to be heard and arbitrated on.

I wrote to you personally, in the hope and expectation that you would honour your commitment made at that meeting in December 2019.

Brid Smith, her PBP colleagues and the representatives of the hundreds of thousands of retired workers who were outside Leinster House on Tuesday 29th June believe that the committee stage and detailed scrutiny processes are the forums that can be used to undertake the consultation process and hear the views of the interested parties mentioned in the Government amendment. Given the likely time frame these processes would take, it allows more than enough time for extensive consultation to be taken if that is the concern.

I listened to yesterday’s debate on the (Industrial Relations Provisions in Respect of Pension Entitlements of Retired Workers Bill 2021) which was presented to the Dail by Brid Smith of People Before Profit.

The Government spokesperson, Minister Damien English, attempted to sidestep the whole issue by introducing an amendment to the Bill which would defer the second reading of the Bill for 12 months, to allow for a consultation process with relevant Ministers, Employers, Trade Unions with absolutely no mention of Retired Workers, the very people whose rights the Bill is intended to protect.

This is an insult to all parties who have campaigned for more than 10 years for the rights and protection of retired workers and to all former workers who have worked for most of their lives in building this country, who are now advanced in years, and don’t have the time to wait another 12 months. There has been more than enough time for all the parties mentioned in Government’s amendment to engage in a consultation process as this issue has been around for more than 10 years.

Previous Governments have lacked the political will to initiate change and introduce proper legal protection for pensioners and give them representation rights that they have earned throughout their working lives.

Brid Smith and her colleagues in People Before Profit have listened to former workers and have acknowledged their right to defend their pension rights once they retire and to be consulted on any changes that may affect their Pension Schemes and their future financial security.

Again, I appeal to you, and the Government, to reconsider your positions and engage with PBP in a process at committee stage that will examine and scrutinise the proposed legislation. It is a basic right that retired workers and their representative organisations are at the table and recognised when their hard-won pensions are being discussed.

This is an equality issue and any attempts to deny Retired Workers the same rights as workers are discriminatory and unjust. There should be “NOTHING ABOUT US WITHOUT US”.

Retired Workers have not gone away and will be back with a vengeance should this Bill fail to progress to committee stage.

Yours sincerely,

National Executive Chairman

ESB Retired Staff Association

119 Elton Court, Leixlip, Co. Kildare, W23 Y4E4

Phone 086 8197083 Email tonycollins6952@gmail.com

On Thu, Jul 1, 2021 at 9:39 AM Micheál Martin’s Office <mmartin.constituency@taoiseach.gov.ie> wrote:

Dear Tony,

Many thanks for your email and for taking the time to write to me.

The Government have agreed to put forward a 12 month timed amendment to Deputy Brid Smith’s Bill – Industrial Relations (Provisions in respect of Pension Entitlements of Retired Workers) Bill 2021- to allow for consultation between the Minister for Enterprise, Trade and Employment, the Minister for Social Protection and the Minister for Public Expenditure and Reform, with unions and employers and the Industrial Relations bodies. This will allow space and time for a full discussion and exploration of legal and technical issues that may arise as a result of the proposals and to consider other options for change which might be available, and which would make it more suitable for collective bargaining.

I recognise that this is a long-running issue for you and members of your association but I want to take this opportunity to assure you that the Government genuinely wants to examine the issue and engage on it with parties from across the sector, including engaging with affected retired workers. It is imperative that as a Government we interrogate this complex mater carefully and tease out its implications. This work will be led by the aforementioned Ministers.

Again, thank you for taking the time to contact me.

With best wishes,

Yours sincerely,

Micheál Martin T.D.

Taoiseach

Department of the Taoiseach | Upper Merrion Street | Dublin 2 | Ireland | D02 R583

Roinn an Taoisigh | Sráid Mhuirfeán Uachtarach | Baile Átha Cliath 2 | Éire | D02 R583

Designated Public Official under Regulation of Lobbying Act, 2015, www.lobbying.ie

Oifigeach Poiblí Sainithe faoin Acht um Brústocaireacht a Rialáil 2015.

UPDATE 29th June, 2021

After 12 Years of Frozen Pensions Government kicks the can down the road for ANOTHER year !

Photos Thanks to Michael Hughes

See email from Brid Smith’s office with Government response to her Bill. It’s ironic that there’s no mention of retired workers in their response. They also talk about collective bargaining, an option currently not available to retired workers. I’m glad to see that PBP are going to test the waters and seek a vote on the Bill.

Tony Collins Chairman ESBRSA National Executive Committee

We just got this from the Government.

Its an amendment to the bill.

Technically it means they are not opposing the bill but want to delay its progress for 12 months to undertake this consultation process.

Its worth noting that the one group they seemed to have forgot to mention in terms of future consultation are retired workers!

In one sense this is a victory of sorts but in another way its very frustrating as there are no guarantees on the outcome of the consultation process so we will have to keep pushing them .

We will be calling a vote on the bill regardless of the amendment and it will be interesting to see what support the bill gets to progress immediately.

DÁIL ÉIREANN

GNÓ COMHALTAÍ PRÍOBHÁIDEACHA

PRIVATE MEMBERS’ BUSINESS

Fógra i dtaobh Leasú ar an Tairiscint don Dara Céim: Notice of Amendment to Second Stage

Motion

An Bille Caidrimh Thionscail (Forálacha i leith Teidlíochtaí Pinsin Oibrithe Scortha), 2021 —

An Dara Céim.

Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill

2021 — Second Stage.

—Bríd Smith, Gino Kenny, Richard Boyd Barrett, Paul Murphy.

Leasú ar an Tairiscint don Dara Léamh:

Amendment to Motion for Second Reading:

- To delete all words after “That” and substitute the following:

“Dáil Éireann acknowledges and resolves that the Industrial Relations (Provisions in Respect of

Pension Entitlements of Retired Workers) Bill 2021 be deemed to be read a second time this

day 12 months, to allow for consultation between the Minister for Enterprise, Trade and

Employment, the Minister for Social Protection and the Minister for Public Expenditure and

Reform, with unions and employers and the Industrial Relations bodies, which will allow for

full discussion and exploration of legal and technical issues that may arise, such as increased

business costs and business viability, as a result of the proposals and to consider other options

for change which might be available, and which would make it more suitable for collective

bargaining.” —An tAire Fiontar, Trádála agus Fostaíochta.

[29 June, 2021]

Leo Varadkar is Tanaiste and The Minister for Enterprise, Trade and Employment

Leo Varadkar is Tanaiste agus An tAire Fiontar, Trádála agus Fostaíochta.

UPDATE 28th June, 2021

The link below is to an Irish Times article by Mark Hilliard which was published on 27th June 2021.

Please note that the demonstration in support of the Bill will take place on Tuesday 29th June2021 at Leinster House, Kildare St, Dublin 2 between 12 and 1pm

UPDATE 24th June, 2021

Attention All ESB Pensioners

The Industrial Relations Provisions in Respect of Pension Entitlements of Retired Workers Bill 2021 will be debated at 10am on Wednesday 30th in the Dail,

A vote should take place either that evening or the following Wednesday.

We ask all members to email/write to the TDs in their constituency asking them to support the Bill.

If you have already done so, a big Thank You and please send a reminder before Tuesday 29th June 29th 2021.

If you have yet to contact your TDs please do so now.

We need to make TDs aware that a large number of Semi State retired Workers have no means of accessing the WRC or any other forum to address their issues regarding their pensions.

The message is ………..”Retired Workers are NOT Retired Voters”

A representative group of members of Semi State Retired Workers will stage a socially distanced demonstration at the gates of Dáil Éireann, Kildare St. on 29th. June between 12:00 and 13:00 to raise awareness among TDs of our support for the Bill.

A format letter below could be adapted by members and their families to send to TDs.

Dear……….,

I am writing to seek your support for the “Industrial Relations Provisions in respect of Pension Entitlements of Retired Workers Bill 2021”, which is due to come before the Dáil on Wednesday 30th June 2021.

Many retired staff receive their pensions from “Occupational Schemes”, established by their former employers. Central to these schemes are pension funds, to which pensioners (as former workers) and their employers contribute and from which pensions are paid.

However, once they have left their jobs, occupational pensioners find that changes which affect pension benefits can be made with little notice or consultation with them. Decisions which affect pension benefits are sometimes influenced by management/union negotiations, from which pensioners are excluded.

The proposed Bill would give pensioners a greater say in how pension benefits are determined. Crucially, it would allow pensioners recourse to the Workplace Relations Commission (WRC) for a ruling, a right which workers currently enjoy.

The Bill would help to restore balance between former and existing workers rights, where pension benefits are concerned and introduce a more level playing field in negotiations which affect pensions.

I believe that society as a whole would benefit from having a fairer system of determining pension entitlements and I urge you to support the proposed Bill.

Yours sincerely

……………………………….

Best Wishes

UPDATE 4th June, 2021

Attention All ESB Pensioners

ESB has been a successful and profitable company over the last 10 years and more, with operating profits averaging €533 million per annum in that period. However, during this successful period ESB has consistently discriminated against you as pensioners, denying you a pension increase, pro-rata representation on the governing bodies of ESB Pension Scheme, and have ignored your right to representation in discussions that would affect your future financial security. You have been denied voting rights on issues affecting you as pensioners, and ESB has ignored the fact that pensioners represent 71% of the total Pension Scheme membership.

ESBRSA has been campaigning for Representation & Arbitration rights for retired workers for more than a decade or so, correspondence with successive Governments that has fallen of deaf ears. Governments that have lacked the political will to initiate change and introduce proper legal protection for pensioners and give them representation rights that they have earned throughout their working lives.

Brid Smith and her colleagues in People Before Profit have listened to former workers and have acknowledged their right to defend their pension rights once they retire and to be consulted on any changes that may affect their Pension Schemes and their future financial security. ESBRSA would like to commend Brid and her colleagues for the major efforts that they have made in bringing forward legislation in the form of this Bill, (Industrial Relations Provisions in Respect of Pension Entitlements of Retired Workers Bill 2021) which will be debated in the Dail on either 30th June or 6th July.

This Bill needs your support and the support of your local TD’s.

ESBRSA urges all ESB Pensioners to use the document below, send it to your TD’s in your own constituencies asking them for their support for this Bill when Brid Smith brings it before the Dail and to vote in favour of passing this Bill into legislation

Give retired workers a voice; Give them the right to be represented on their pension schemes.

Five reasons you should support the Right to Representation for retired workers.

1. The Bill (Industrial Relations Provisions in Respect of Pension Entitlements of Retired Workers Bill 2021) will be debated in the Dail in early July when it is introduced by Brid Smith of People before Profit. It gives a voice to retired workers over what happens to their occupational pension schemes after they have left their employment. At present, thousands of workers who have worked for decades in a company or a semi state find that once they have left their job, any changes that impact their pension schemes can happen with little notice or consultation with them. This Bill will change that.

2. The Bill will give retired workers and their representative associations the right to go to the WRC when their occupational schemes are affected or there are proposed changes that could affect their benefits. At present, if these changes happen more than six months after a worker has retired they have no rights to access the WRC ; This Bill will change that.

3. The Bill will give rights to retired workers associations to be consulted when talks between trade unions and employers may have direct effects on their occupational pension schemes. At present, retired workers are not consulted in industrial relations disputes that may have an impact on their pensions ; This Bill will change that.

4. This Bill will ensure that one position was reserved for retired pensioner members who were standing for elected positions on trustee boards in some circumstances. Retired workers can often struggle to have their voice heard on their scheme’s Trustee Board; no positions are currently reserved for retired members; This Bill will change that.

5. Retired workers and their associations cannot currently access the WRC, because of the definition of a trade dispute in legislation, this means even where substantial cuts or changes have happened to their pensions, retired workers have no effective forum to seek redress or demand consultation. This Bill will change that.

Retired workers have endured a decade of attacks on their pensions, and all workers are facing further attacks on the very idea of a decent pension when they retire. The right to retire at 66 itself is constantly under pressure from Governments and employers. We believe that pensions are deferred wages, hard won by long struggle of workers and their trade unions in many cases. However, deals between companies and trade unions can result in significant and long-lasting changes to retired workers pension entitlements. Yet, those workers who have often paid into schemes for decades and been active trade union members have no say in those deals and are not even consulted in advance.

This Bill will change that and correct a deep injustice done to all retired workers.

This Retired Workers Rights bill will challenge that and ensure that retired workers and their representative organisations are at the table and recognised when their hard-won pensions are being discussed.

“Nothing about us Without us” is the catch cry of many social movements and so it is with retired workers who are asking that you support their right to be represented and able to defend their pensions after they have retired.

Please lend your support to the Bill

UPDATE 9th May, 2021

With regret we inform you of the death of our former colleague Martin Gibbons of Parknahown, Cullohill, Co Laois. Martin worked in Generation before moving to Portlaoise district as Transmission Engineer. Martin died on 8th May and his funeral is on Monday 10th at 1:00 pm. See RIP.ie for details

RIP.ie notice for Martin Gibbons

UPDATE 15th January, 2021

We have been advised by Bríd Smith TD PBP that she will be introducing a proposed bill entitled Industrial relations amendment (Provisions in Respect Pension Entitlements of Retired Workers) Bill 2020 the Dail.

Briefly the bill aims to give greater representative rights for retired workers and their representative organizations when it comes to issues around their occupational pension schemes. It does this by changing certain clauses in the Industrial Relations act to expand the time period in which retired workers can take a case to the WRC for example and by changing the definition of trade dispute, strike and by adding organizations representing retired persons to other clauses in order to expand their rights.

The links below will bring you to pdf files of an explanatory memo and the Bill.

http://www.esbrsa.ie/wp-content/uploads/2021/02/final-pension-explanmemo.pdf